Oil rises on US stock decline, but manufacturing slowdown caps gains

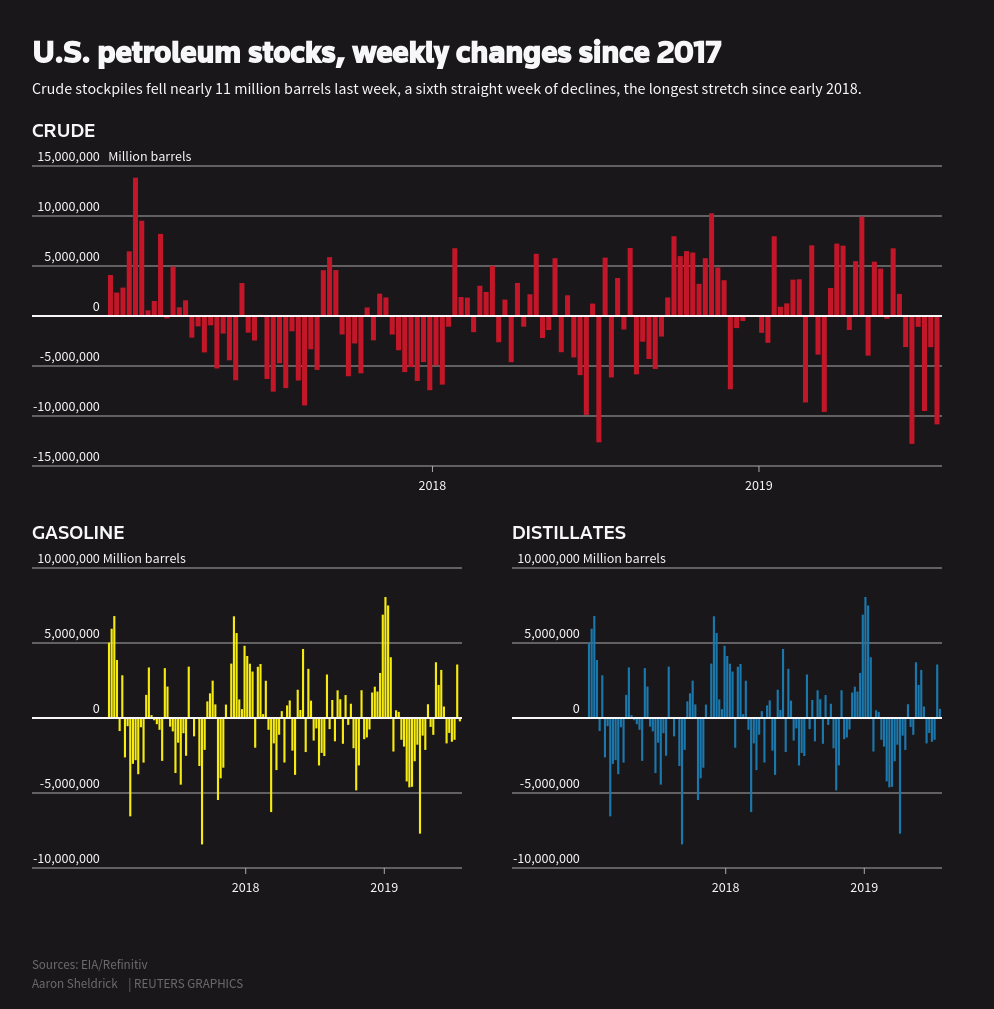

US crude stocks fell by nearly 11 million barrels last week, the Energy Information Administration reported on Wednesday

Oil prices rose on Thursday amid Middle East tensions and a big fall in US crude stocks, but gains were capped as weak Western manufacturing data indicated slowing economic growth and in turn the potential for reduced fuel demand.

Brent crude futures LCOc1 rose 36 cents or 0.6% to $63.54 a barrel by 0855 GMT, after dropping 1% on Wednesday - the first fall in four sessions.

US West Texas Intermediate crude CLc1 was up 31 cents, or 0.6%, at $56.19 a barrel, having dropped 1.6% in the previous session.

US crude stocks fell by nearly 11 million barrels last week, the Energy Information Administration reported on Wednesday, well above analysts’ expectations for a drop of 4 million barrels.

“While that draw was influenced by temporary factors - Hurricane Barry - US crude inventories have plunged by 40 million barrels over the last six weeks, suggesting the oil market is finally rebalancing,” UBS analyst Giovanni Staunovo said.

Oil prices have also been under pressure from concerns about global economic growth amid growing signs of harm from the US-China trade war that has rumbled on over the last year.

However, the White House said on Wednesday top US and Chinese negotiators would meet next week to continue talks, and global equities edged up on the news.

“Despite the bullish supply-side fundamentals and geopolitics that support oil prices, it seems that the market needs a positive economic catalyst to move appreciably higher,” said Harry Tchilinguirian, global oil strategist at BNP.

“If we get positive echoes next week from renewed US-China trade talks, then oil can advance noticeably higher.”

A series of purchasing manager index (PMI) readings in the United States and Europe were weaker than expected.

The German PMI, tracking the manufacturing and services sectors, hit a seven-year low in July, suggesting a deteriorating growth outlook for Europe’s largest economy. The fall was driven by the auto sector on poor sales to China.

Set against those worries are tensions in the Middle East following the seizure of a British-flagged tanker in the Gulf by Iranian forces last week.

The military adviser to Iran’s supreme leader was quoted on Wednesday as saying any change in the status of the Strait of Hormuz, which Tehran says it protects, would open the door to a dangerous confrontation.

Britain, meanwhile, gained initial support from France, Italy and Denmark for its plan for a European-led naval mission to ensure safe shipping in the Gulf.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel