Remittance receipts rise but growth falls

Total receipts stood at $16.42 billion in FY19

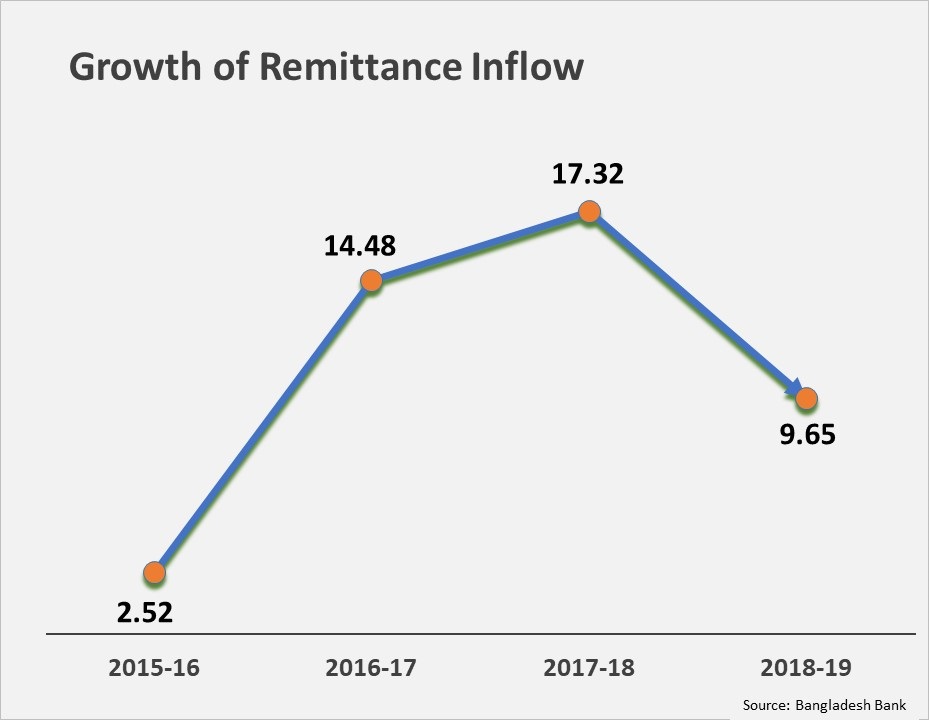

The remittance receipts saw all-time high, but its growth fell to 9.64 percent in the just-concluded fiscal year, compared to 17.32 percent in the preceding fiscal year.

The total receipts stood at $16.42 billion in the 2018-19 fiscal year, according to the Bangladesh Bank (BB) data.

Two factors – a fall in manpower export and a tendency to send home money through mobile banking – mostly contributed to the sluggish remittance growth.

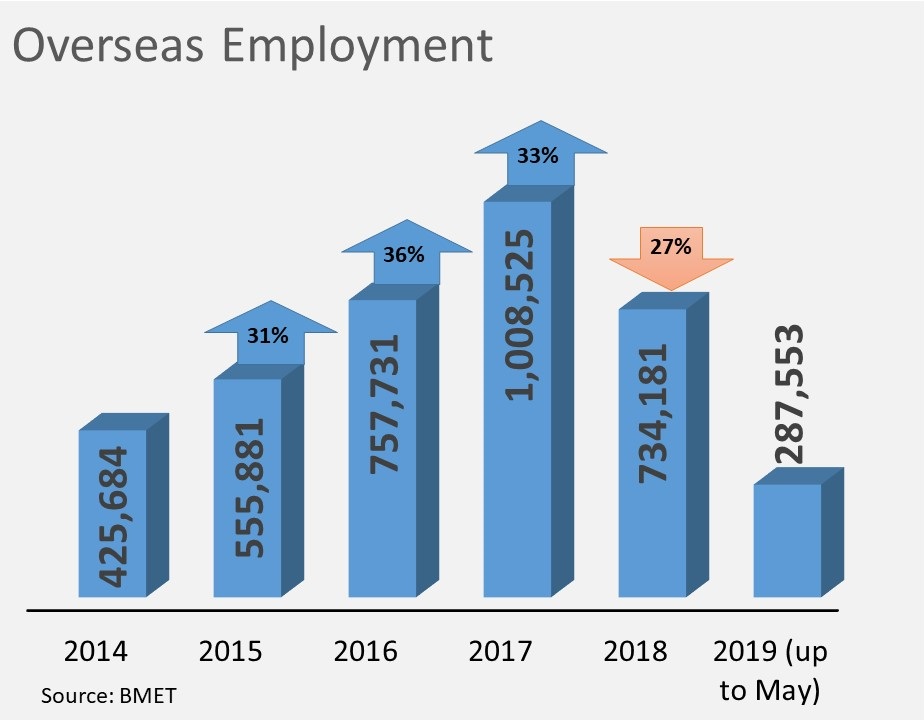

The manpower export declined by 27 percent last year in comparison to the previous year, according to Bureau of Manpower Employment and Training (BMET).

To boost up remittance growth, the BB has already integrated a mobile banking channel with banks to send remittance through banking network.

bKash, the most popular mobile banking platform, joined hands with different global money exchanger companies to bring in remittance through the alternate payment channel.

In the latest move to increase remittance inflow, the government announced 2 percent cash incentive for the remitters in the new budget for the current fiscal year.

The remittance inflow, which remained sluggish for last three years, started to pick up uptrend since January this year, thanks to a rise in dollar price.

The high import expenditure led to a hike in dollar price, encouraging remitters to send home more money through the banking channel.

The good inflow of foreign currency also helped reduce the trade deficit to $13.67 billion in the first 10 months of the 2018-19 fiscal year from $15.26 percent in the same period of the 2017-18 fiscal year, according to the BB data.

The import growth, which went up to 25 percent in the fiscal year 2017-18, has come down recently, registering four percent rise in the first 10 months of FY19.

The high import payment created pressure on the foreign exchange market, compelling the central bank to devalue local currency.

The dollar price surged to Tk84.5 in July, which was Tk83.75 during the same period last year, the central bank data showed.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel