The BASIC problem

Default loans keep rising, pulling bank to brink

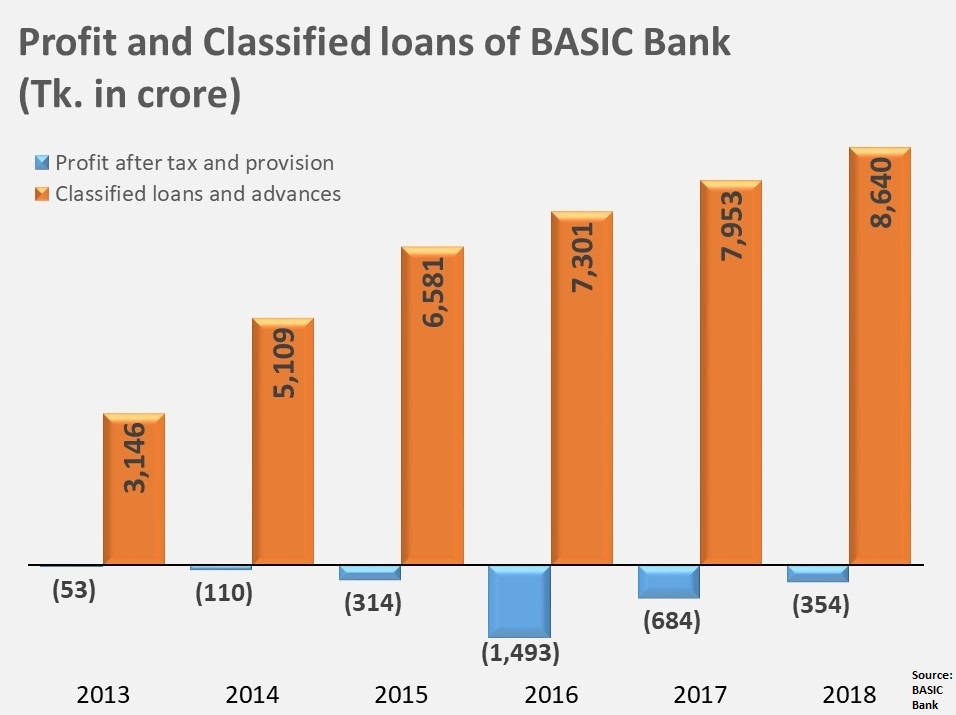

BASIC Bank’s state of financial health continues to sink as the bank’s default loan kept on rising despite attempts to bring it down.

Besides, management crisis has put additional pressure on the bank as the post of its managing director remained vacant for eleven months.

The bank rescheduled loans worth Tk1,286 crore last year. Yet, its classified loan increased by around Tk700 crore.

A rescheduled loan is regularising a default loan and is paid over a longer period, usually with a lower down payment amount.

The bank’s default loan has risen every year in the last six years, with the amount reaching Tk8,639 crore in December 2018 – the highest-ever figure for the bank and 56 percent of its total loan.

However, huge loan rescheduling has helped the bank to reduce the loss almost by half – from Tk684 crore in 2017 to Tk354 crore last year, according to the bank’s annual report.

Loan rescheduling was the major tool that the bank used to minimize its classified loan since the Tk4,500 crore scam was revealed in 2013. However, it did not work as 90 percent of its borrowers failed to continue their payment even after getting the relaxed rescheduling facilities.

Every year the bank has been taking forbearance of over Tk2,000 crore and the government has injected around Tk3,000 crore so far since 2014 to solve the fund crisis.

Banks are required to keep a certain amount aside against bad loan to mitigate future risks known as provisioning. With forbearance the bank did not have to follow this rule.

BASIC Bank’s capital deficit improved to Tk218 crore last year from Tk2,780 crore a year before, thanks to its provision forbearance.

Despite all these helps, the bank continued its streak of loss for the last six years.

The bank failed to improve its financial health only due to the continuous rise in default loan, said BASIC Bank Chairman Alauddin A Majid.

“Despite providing rescheduling facilities to the clients at discounted down payment, they could not continue their installment payment” added Majid.

Meanwhile, the government took eleven months to appoint a managing director to the bank, a sign that the bank is no more in its priority list. On June 27, the ministry nominated Md. Rafiqul Alam as the managing director, who served at Rajshahi Krishi Unnayan Bank in the same post although he has not joined yet.

The bank’s managing director Muhammad Awal Khan resigned in August last year in the face of challenges involving improvement of the bank’s financial health.

The board of the bank has been trying to persuade the Finance Ministry to speed up the appointment of a managing director.

“Why the government is so slow in processing the appointment of the managing director remains very mysterious,” said BASIC Bank Chairman Alauddin A Majid.

Bangladesh Bank also relaxed its monitoring of BASIC Bank as its instructions to improve the bank’s health were not carried out, said a senior executive of the central bank on condition of anonymity.

“We lost our interest in holding regular meetings with the bank as general managers and deputy general managers came to attend meetings. But they are not authorized to carry out central bank instructions,” he said.

BASIC Bank, once a healthy state bank, was put in jeopardy as around Tk4,500 crore was siphoned off between 2009 and 2013 when the bank’s former chairman Sheikh Abdul Hye Bacchu chaired its board.

Money was embezzled from the bank through shell companies and dubious accounts, according to a Bangladesh Bank report. The loan scam first came to light after a Bangladesh Bank enquiry.

The enquiry unearthed the loan scam and the central bank’s report to the Anti-Corruption Commission detailed how money was embezzled from the bank through various schemes.

The enquiry report stated Bacchu illegally influenced all activities of the bank.

In 2014, Bacchu resigned as the chairman amid growing allegations that he misappropriated funds by approving shady loans worth several thousand crores of taka.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel