New tax measures likely for electric car registration

NBR says the measures will bring electric vehicles under the tax net through easy calculations

The government is likely to introduce a new measure to make realising advance income tax from registrations of electric vehicles easier in the budget for the fiscal year 2021-22.

In the wake of the growing popularity of such vehicles, the National Board of Revenue (NBR) has proposed bringing an amendment to Section 68B of the income tax ordinance 1984 to clarify electric car tax measures, said finance ministry sources.

Finance Minister AHM Mustafa Kamal is scheduled to table the proposal in Parliament during the budget session on Thursday (today).

Bangladesh Road Transport Authority (BRTA) currently cannot collect advance income tax from electric vehicles due to the absence of required provisions in the finance act. Generally, this tax is realised by BRTA from private vehicle owners at the time of registration and renewal of fitness certificates.

In the existing finance act, advance income tax rates are set according to vehicles' engine capacities, known as cc (cubic centimetre), but electric vehicles do not have any engine and their motor capacity is measured in kilowatt.

NBR officials said the new measure would bring electric vehicles under the tax net through easy calculations. The revenue board has proposed a new evaluation measure for electric vehicles, which may consider 20cc the equivalent of 1kw.

Tax officials said they would bring electric vehicles under the advance income tax net in the new budget.

Abdul Haque, president of Bangladesh Reconditioned Vehicles Importers and Dealers Association, welcomed the initiative. He said the calculation of electric vehicles' motor capacity is problematic and this move would make registrations and revenue realisation easier.

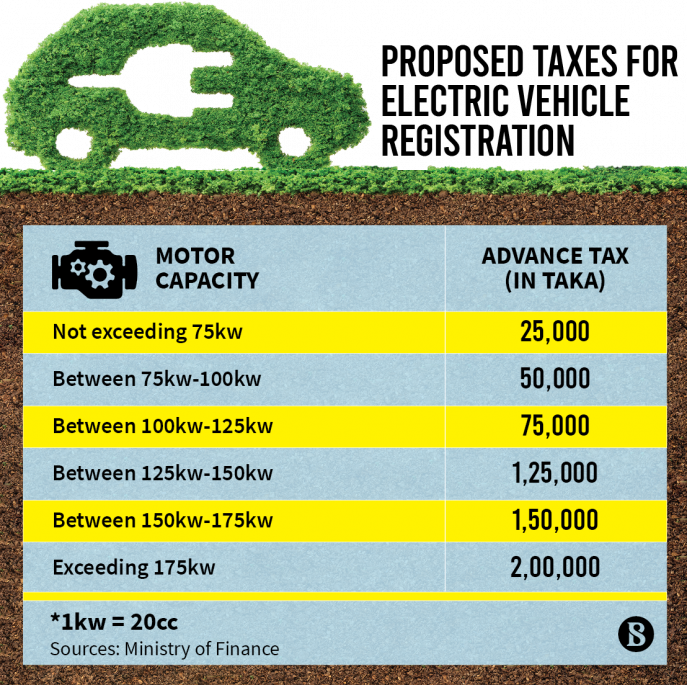

According to the finance act, private car owners have to pay advance income tax at different rates, starting from Tk25,000 to as high as Tk200,000.

The new budget proposal says the advance income tax on an electric vehicle with 75kw motor capacity will be Tk25,000, which is equal to that on a car or a jeep with an engine capacity not exceeding 1,500cc.

On the other hand, the highest tax on a motor car will be Tk200,000 with motor capacity of more than 175kw. This vehicle will be treated as a car or a jeep with an engine capacity exceeding 3,500cc.

The NBR also proposed setting Tk50,000 as advance income tax on a motor vehicle with a capacity between 75kw and 100kw, Tk75,000 on a motor vehicle with a capacity between 100kw and 125kw, and Tk125,000 on a motor vehicle with a capacity between 125kw and 150kw. The amount of tax will be Tk150,000 on a motor vehicle with a capacity between 150kw and 175kw.

According to the Motor Vehicle Rules 1984, an electric vehicle means a vehicle powered exclusively by one or more electric motors, which get traction energy from a rechargeable battery installed in the vehicle. Such vehicles do not include battery-run bicycles or rickshaws.

BRTA has already moved to finalise the guidelines on the registration and operation of electric vehicles. The draft of the guidelines styled Electric Vehicle Registration and Operation Guidelines was formulated in November 2018.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel